ACADEMIA

Xcelerit Forges New Tools for Quantitative Finance

Xcelerit launches ’Quant’ toolkit to accelerate financial applications

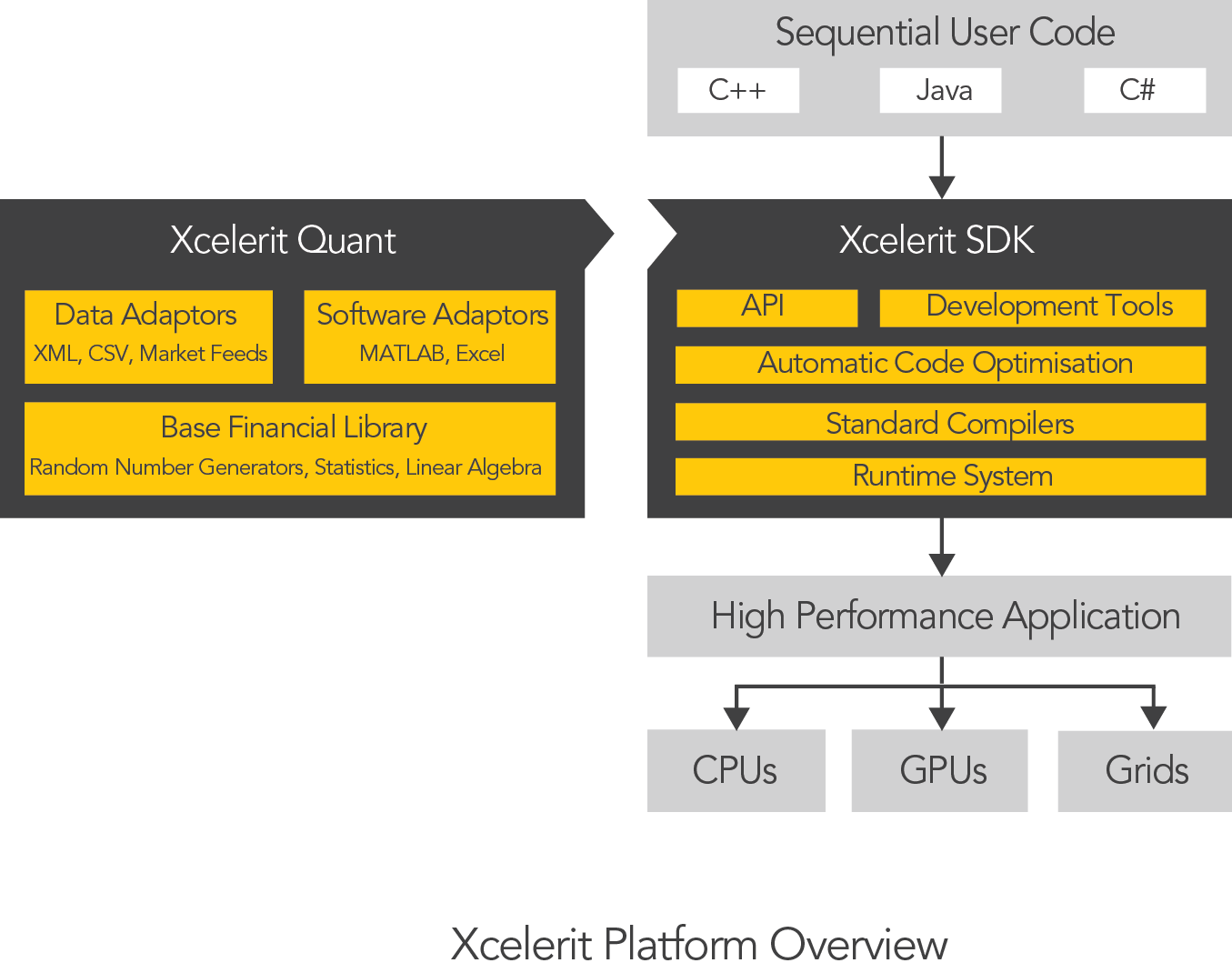

Xcelerit haslaunched its new ‘Quant’toolkit. The toolkit comes as an extension to the Xcelerit SDK and is targeted at quantitative analysts anddevelopers working in areas such asinvestment banking, asset management, insurance, andlive sports betting to enable them to easily extract maximum performance out of their compute resources.

The launch is timed to coincide with the forthcoming Global Derivatives, Trading & Risk Management conference in Barcelona which gathers together a global audience of technical and financial specialists in this space. “We are signalling to all conference attendees that there is now a much more efficient way to respond to today’s computational challenges such as the increased complexity of risk computationsimposed by the Basel-II and Basel-III accords“, said Hicham Lahlou, CEO of Xcelerit,“and we will be using the conference to meet with and impart this message to some of our key customers”, he said.

Xcelerit’s new ‘Quant’extension is born out of their experience with customers in diverse financial services fields. It brings a new tailored acceleration solution for mathematicians combining performance, flexibility, and ease-of-use. In today’s rapidly changing markets and regulatory environment, financial services firms need to be able to quickly respond to changes with flexible in-house software. At the same time, with increasingly complex numerical techniques being employed, developers are taskedwith writing efficient programs that can leverage multi-core processors or even exciting new hardware platforms such as GPUs. “We know that these customers need support for different numerical methods as well as various base financial routines”, said Lahlou, “and they need it to run super-fast on theirproduction grid”. ‘Quant’comes equipped with routines that are highly optimised for each supported hardware platform. The toolkit automatically detects available compute resources and choosesthat which is most appropriate.

‘Quant’is also designed to talk to popular packages such as MATLAB or Excel. ”Very often, we find that users like to solve part of the problem in one of these tools, and then deal with the performance-critical parts using Xcelerit”, says Lahlou. “Our new ‘Quant’ toolkit makes this a snap”, he said. To further ease integration, the software is designed for use with common market data feed formats.

Existing financial applications written in C++, C# or Java can now undergo minor modifications to integrate the ‘Quant’ toolkit and once convertedwill efficiently run on multi-core CPUs, GPUs, or grids with blindingly fast speed. Users can target all supported hardware with the same source code. They can focus on their algorithms and the problem at hand, and the toolkit takes care of the efficient execution.

‘Quant’is available for licensing to customers to run on their own hardware, but is also available pre-installed as part of Xcelerit’s cloud-computing offering in association with PEER 1 Hosting. “This really is instant access”, said Xcelerit’s Lahlou. “In less than an hour, we can have you writing your financial modelsthat can execute on high-end CPUs and GPUs with all the software support already in place”, he said.