PROCESSORS

Intel reports the largest quarterly loss in its history

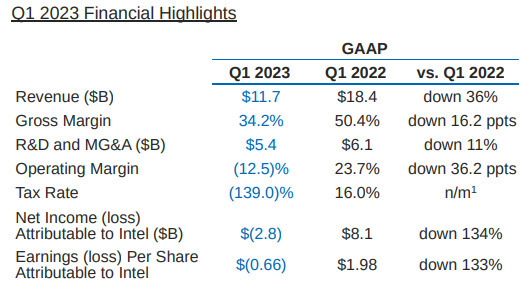

Intel has reported first-quarter 2023 financial results that showed a staggering 133% annual reduction in earnings per share. The company's revenue has dropped nearly 36% to $11.7 billion from $18.4 billion a year ago.

In the first quarter, Intel turned to a net loss of $2.8 billion, or 66 cents per share, from a net profit of $8.1 billion, or $1.98 per share, last year.

It’s the fifth consecutive quarter of declining sales and the second consecutive quarter of losses. It’s also Intel’s largest quarterly loss of all time, beating out the fourth quarter of 2017, when it lost $687 million.

“We delivered solid first-quarter results, representing steady progress with our transformation,” said Pat Gelsinger, Intel CEO. “We hit key execution milestones in our data center roadmap and demonstrated the health of the process technology underpinning it. While we remain cautious on the macroeconomic outlook, we are focused on what we can control as we deliver on IDM 2.0: driving consistent execution across process and product roadmaps and advancing our foundry business to best position us to capitalize on the $1 trillion market opportunity ahead.”

David Zinsner, Intel CFO, said, “We exceeded our first-quarter expectations on the top and bottom line, and continued to be disciplined on expense management as part of our commitment to drive efficiencies and cost savings. At the same time, we are prioritizing the investments needed to advance our strategy and establish an internal foundry model, one of the most consequential steps we are taking to deliver on IDM 2.0.”

Intel previously announced the organizational change to integrate its Accelerated Computing Systems and Graphics Group into its Client Computing Group and Data Center and AI Group. This change is intended to drive a more effective go-to-market capability and to accelerate the scale of these businesses, while also reducing costs. As a result, the company modified its segment reporting in the first quarter of 2023 to align with this and certain other business reorganizations. All prior-period segment data has been retrospectively adjusted to reflect the way the company internally receives information and manages and monitors operating segment performance starting in the fiscal year 2023.